Private Debt News Weekly Issue #78: Blue Owl Becomes the Venn Diagram, Returns Fade, and Inflows Keep Coming

Short interest rises as shares drop a third since July while investors pour $30 billion into unlisted BDCs despite trailing public high-yield bonds

Follow me on Twitter. Interested in sponsoring Private Debt News? Discounted rates available for early sponsors—get in touch here or via e-mail.

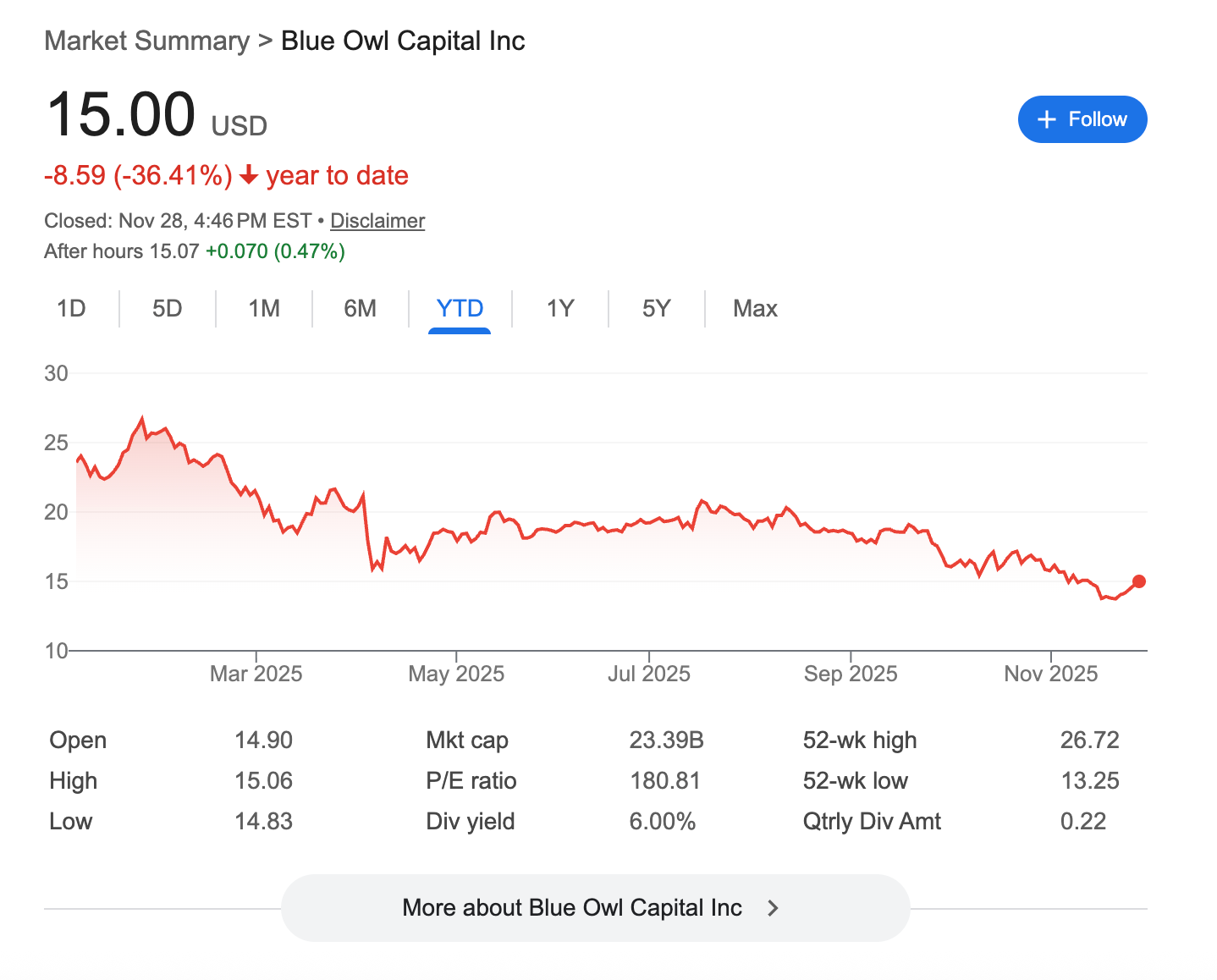

Blue Owl Capital has become the focal point for every market anxiety about private credit. Short interest has risen steadily since August while declining or staying flat for listed rivals like Ares and Apollo. Shares have dropped by a third since mid-July, significantly underperforming peers in the past month. The firm sits squarely in the crosshairs of worries about private credit quality, AI data center spending, and the reliability of wealthy individual investors who’ve been the growth engine for alternative managers.

“It appears to be an opportunity to be greedy when others are fearful for hard-to-explain, ungrounded reasons,” co-CEO Marc Lipschultz told Barron’s this week, pushing back on what he called market delusion about private credit risks. Blue Owl’s listed BDC trades at a 21% discount to NAV, and average annual realized credit losses are running at just 0.13% of total loans. The firm has committed more than $50 billion in the past two months alone to build data centers for Meta, Oracle, and other hyperscalers.

Yet the skepticism persists. According to Bloomberg Opinion’s Paul Davies, Blue Owl’s stock “looks like a decent hedge for today’s troubles.” Wall Street analysts almost all rate it a buy, but more than half its assets are in private credit and it’s leaned heavily into data center financing, including backing the three largest projects built in the past year.

Meanwhile, capital keeps flowing into the asset class even as returns decline. Unlisted public BDCs attracted more than $10 billion of net inflows in Q3, bringing total assets to over $123 billion, a 33% increase from year-end 2024. Through September, the vehicles pulled in approximately $30 billion YTD. Blackstone’s BCRED, at nearly $47 billion, is more than double the size of the next biggest fund and took in the most new money.

The catch: returns are trending lower. The median unlisted public BDC returned 6.2% in the first three quarters of 2025, trailing the Morningstar US High Yield Bond Index at 7.2% and roughly matching US core bonds at 6.1%. Both the base rate and credit spreads have compressed. Three-month SOFR peaked at 5.34% in December 2023 and has since fallen to 4.22%, with an 80% probability of another 75 bps of cuts by end of 2026 according to CME FedWatch.

In Europe, another lender is taking the keys. Permira Credit is in advanced talks to take over German tour operator Berge & Meer, a company it originally financed with a €52 million loan in 2019. An additional €14.1 million loan to cover accrued interest carried a 20% rate. The move adds to the growing pattern of direct lenders converting debt positions to equity stakes.

And the SEC is probing Jefferies over whether the bank gave investors in its Point Bonita fund adequate information about exposure to First Brands, according to the Financial Times. The inquiry is examining internal controls and potential conflicts within and between different parts of the bank.

Key Market Themes

1. Blue Owl Becomes the Market’s Favorite Target

Blue Owl shares have dropped by a third since a mid-July peak for private markets firms, significantly underperforming peers in the past month. Short interest has risen steadily since August while declining or staying flat for rivals like Ares and Apollo. The firm is caught in a trifecta of concerns: private credit quality, AI data center valuations, and the reliability of wealthy individual investors.

According to Morningstar analyst Greggory Warren, stock markets may have punished Blue Owl more than peers because it’s the smallest of the big seven listed alternative managers, making short bets more effective. The firm has grown rapidly through acquisitions, which can make a company seem riskier when sentiment turns. And it has pushed hard into wealth markets, where investors can demand money back more quickly than large institutions.

Co-CEO Marc Lipschultz argues the concerns are overblown. “The facts are that Blue Owl’s business is really good,” he told Barron’s. “We have had a stellar year in the face of deep volatility.” He pointed to record capital commitments in the past 12 months, 20% top-line growth, and realized credit losses of just 0.13% of total loans.

The Transparency Problem

With little public information on credit ratings, outlooks, or downgrades, investors have no choice but to draw their own pictures from flashes of detail. Twice this year, private credit-funded businesses went from apparently healthy to bankrupt in weeks. Neither Zips Car Wash nor Renovo Home Partners were in Blue Owl’s funds, but the cases illustrate uncertainty in this lending class.

2. $30 Billion Flows Into Unlisted BDCs Despite Falling Returns

Investors added more than $10 billion of net inflows to unlisted public BDCs in Q3, bringing overall net assets to more than $123 billion, a 33% increase from year-end 2024. Through September, these vehicles attracted approximately $30 billion YTD. Blackstone’s BCRED, at nearly $47 billion, continues to dominate, more than double the size of the next biggest fund.

But returns are trending lower. The median unlisted public BDC returned 6.2% in the first three quarters of 2025, trailing the Morningstar US High Yield Bond Index at 7.2% and roughly matching US core bonds at 6.1%. The comparison is notable: BDCs employ fund-level leverage to boost returns while the bond benchmarks are unleveraged.

According to Morningstar, this year’s performance “offers a useful reality check for investors: Private markets are not immune to market cycles.” Like any asset class, they benefit from favorable conditions and face headwinds when conditions turn.

Headwinds Accumulating

Most BDC loans pay floating-rate coupons consisting of a base rate plus credit spread. Both components have drifted lower. Three-month SOFR peaked at 5.34% in December 2023 and has fallen to 4.22% as of September, not yet reflecting an additional 25 bps cut announced in late October. According to CME FedWatch, there’s an 80% chance of another 75 bps of cuts by end of 2026.

3. Spread Compression Adds to Return Pressure

PitchBook LCD analysis of more than 100 BDC portfolios shows a noticeable shift toward lower-spread credits between Q3 2024 and Q2 2025. The pattern is typical in rapidly growing asset classes: as more money flows in, competition to deploy it increases and puts downward pressure on borrowing rates for companies.

At the same time, managers may be seeking higher-quality deals with lower default risk as economic uncertainty lingers. According to Morningstar, this suggests continued pressure on returns as demand from investors shows no signs of slowing.

Managers are getting more defensive. In September, BCRED announced it was cutting distributions from $0.22 per share to $0.20 starting in October while noting it “aims to manage risk prudently.” On Apollo’s Q3 earnings call, CEO Marc Rowan told investors private credit was more attractive in previous years and that the firm is focused on reducing risk for clients.

Market Reality

This year’s unlisted BDC performance serves as a reminder that private markets don’t always outperform public markets. According to Morningstar, “there’s no need to panic” but investors should “use this as an opportunity to set realistic expectations for the asset class.”

4. Permira Credit Takes Equity in German Tour Operator

Permira Credit is in advanced talks to take over German tour operator Berge & Meer, another sign of direct lenders moving to equity positions to support borrowers. Permira Credit already holds equity in the company alongside principal shareholder Genui GmbH.

Genui’s 2019 takeover was financed by a €52 million loan from Permira Credit as sole senior secured lender. To deal with pandemic-era lockdowns, Berge & Meer took loans from German state-owned development bank KfW and the German Economic Stabilization Fund. The acquisition financier also granted a €14.1 million loan to cover accrued interest at a 20% rate.

According to CEO Marcel Mayer, the main objective is to “provide additional growth capital” and the company is now “solidly profitable” after recovering from the pandemic.

European Pattern

Private credit firms across Europe have been grappling with how to support portfolio companies as they face the first wave of refinancings since direct lending took off. In Europe, sole lenders are common, in theory allowing for quicker and more tailored negotiations than in broadly syndicated markets with a wider range of creditors.

5. Jefferies Makes First Saudi Private Credit Move

Jefferies Financial Group led a $125 million financing deal for Riyadh-based finance startup Erad, marking the investment bank’s first foray into Saudi Arabia’s private credit space. Co-investor Channel Capital is providing an asset-backed, scalable facility to boost Erad’s lending to domestic small-and-medium sized companies.

The deal joins a wave of Wall Street activity in the kingdom. Two months ago, Saudi buy-now-pay-later unicorn Tamara secured an asset-backed facility of as much as $2.4 billion from Goldman Sachs and Citigroup. Until recently, private credit barely existed in Saudi Arabia, but domestic banks are constrained by funding needs from the country’s economic overhaul.

According to Erad co-founder Salem Abu-Hammour, the deal “demonstrates the strategic importance of alternative finance in supporting the Kingdom’s goal of SME growth.” Gulf SMEs face a $250 billion financing gap limiting their growth potential.

Strategic Positioning

The facility will help Erad broaden beyond consumer sectors into manufacturing, logistics, distribution, and real estate services. For Jefferies, it’s the bank’s first asset-backed financing transaction in Saudi Arabia as it continues building Middle East presence.

6. SEC Probes Jefferies Over First Brands Disclosures

The SEC is probing Jefferies over its relationship with First Brands Group, according to the Financial Times. The regulator is seeking information about whether Jefferies gave investors in its Point Bonita fund adequate information about their exposure to the bankrupt auto parts supplier.

The inquiry is also examining internal controls and potential conflicts within and between different parts of the bank. The probe is at an early stage and it’s unclear whether it will result in any allegations of wrongdoing.

Jefferies declined to comment to the FT while the SEC said it does not comment on the existence or non-existence of possible probes.

Broader Scrutiny

The investigation adds to ongoing scrutiny of the First Brands collapse, which has sparked finger-pointing between banks and private credit firms over underwriting standards and due diligence. The inquiry focuses on disclosure practices rather than the underlying lending decisions.

7. Lipschultz Defends Data Center Thesis

Blue Owl has committed more than $50 billion in the past two months to build data centers for Meta, Oracle, and other AI hyperscalers. These are among the largest privately funded capital projects in modern history. Lipschultz argues the underlying infrastructure is a necessity and the long-term leases are backed by corporate guarantees.

“The right lease, with no ability to leave your lease and with a guarantee from the corporate parent, is an exceptionally secure instrument,” Lipschultz told Barron’s. “There is no way for them to say ‘Oh, I don’t want that thing anymore.’ Unless they are bankrupt, they owe the money.”

He acknowledged uncertainty about AI company valuations but argued investors should focus on infrastructure rather than venture bets. “The best risk-return investments I have seen in my career, and I have been in the private investment business for 30 years, are attached to the digital infrastructure component of this transition.”

The Counter-Argument

Critics note there are questions about whether AI models will generate sufficient revenue to fund all the computing power being created. Many chips, representing most of the investment, have useful lives far shorter than 15-to-20-year data center contracts. Lipschultz counters that hyperscalers “actually understand what these models are capable of” and are “putting trillions of dollars where their mouths are.”

Deals of Note

Erad - Jefferies leads $125M asset-backed facility for Saudi finance startup, first Saudi private credit deal for the bank. Co-investor Channel Capital participates

Berge & Meer - Permira Credit in advanced talks to take over German tour operator originally financed with €52M loan in 2019, adding €14.1M accrued interest loan at 20% rate

Tamara - Saudi BNPL unicorn secured $2.4B asset-backed facility from Goldman Sachs, Citigroup and others (closed two months ago)

What It Means

Blue Owl becoming the market’s favorite target while unlisted BDCs attract $30 billion of inflows captures the disconnect between retail enthusiasm and institutional skepticism. Short interest rising since August while flows keep coming suggests different investor cohorts are reaching opposite conclusions about private credit’s trajectory.

The return data supports the skeptics. Median unlisted BDC returns of 6.2% trailing high-yield at 7.2% through three quarters isn’t catastrophic, but it’s not the outperformance that justified the illiquidity premium. With SOFR down from 5.34% to 4.22% and spreads compressing as capital floods in, the math gets harder. BCRED cutting distributions and Apollo’s Rowan talking about “reducing risk” signals managers see what’s coming.

Lipschultz calling investor fears “ungrounded” and comparing market anxiety to the Mandela Effect is a bold defense. Average realized losses of 0.13% and record capital commitments support his case. But the transparency problem is real: with no independent ratings commentary and valuations diverging widely on stressed credits, investors fill the information vacuum with worst-case scenarios. Blue Owl sits in the middle of a Venn diagram of concerns, and that’s why it’s getting whacked regardless of underlying fundamentals.

Permira Credit taking over Berge & Meer after financing it since 2019, with an additional accrued interest loan at 20%, shows the European refinancing wave playing out. The company is now “solidly profitable” according to management, but the lender becoming the owner wasn’t the original plan. These conversions produce different risk profiles than the stable income streams investors signed up for.

The SEC probing Jefferies over First Brands disclosures extends scrutiny beyond underwriting into fund-level transparency. Whether Point Bonita investors had adequate information about their exposure is a different question than whether the loan itself was poorly underwritten. Both matter, but the disclosure inquiry suggests regulators are looking at the full chain from origination to distribution.

Capital keeps flowing because yields still exceed alternatives and institutions need deployment. But when the median unlisted BDC trails public high-yield, the premium investors pay for illiquidity stops justifying itself. The 33% asset growth in nine months into a declining return environment creates the setup for disappointment when expectations meet reality.